PMG Zambia Has Scammed Millions of Kwacha from Dull Zambians!

PMG Zambia Has Scammed Millions of Kwacha from Dull Zambians!

PMG Zambia Has Scammed Millions of Kwacha from Dull Zambians!

TRENDING: Yet another shocking financial scam has hit Zambia, as “PMG Zambia” reportedly swindles millions of kwacha from unsuspecting citizens. The scheme, which masquerades as a legitimate marketing and advertising agency, has left many asking: why do Zambians continue to fall for these Ponzi-style traps?

What Is PMG Zambia?

PMG Zambia, short for Performance Marketing Group, presents itself as a mobile-based marketing platform where users can earn money by completing simple tasks. According to the promoters, members could watch and comment on short film trailers, pay a “security deposit,” and receive fixed daily returns. The pitch sounds harmless—and even appealing—but there’s a catch.

The scheme is structured in tiers, where higher deposits promise higher daily returns. To lure more investors, PMG Zambia employs social media influencers and offers commissions for recruiting friends and family. In essence, the system depends on continuously attracting new members to pay the returns of older ones—a hallmark of Ponzi schemes.

How Zambians Were Duped

Despite numerous warnings, millions of kwacha have already been lost to PMG Zambia. Victims report being swayed by slick marketing campaigns, flashy apps, and the promise of effortless income. Social media platforms were flooded with “success stories,” which further fueled trust and encouraged more people to join.

One concerned investor lamented, “I thought this was a safe way to make extra money. Now, I’ve lost my life savings, and the company is nowhere to be found.”

Authorities like the Zambian Securities and Exchange Commission (SEC) have since flagged PMG Zambia as a suspected Ponzi scheme, warning citizens that such investment models are illegal and unsustainable.

Why Ponzi Schemes Keep Tricking People

You might wonder: why do Ponzi schemes keep flourishing despite repeated warnings? Experts explain that they prey on human psychology:

-

Greed and the allure of quick money: Promises of daily returns make people ignore obvious red flags.

-

Social proof: Seeing friends or social media influencers profit creates a false sense of security.

-

Lack of financial literacy: Many victims don’t understand how investment and legitimate businesses truly work.

As long as these psychological triggers remain, unscrupulous operators like PMG Zambia will continue exploiting them.

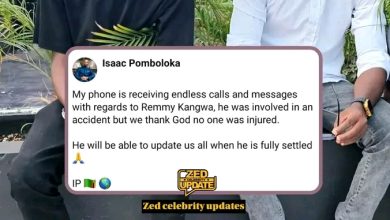

The Social Media Buzz

Social media users have expressed outrage and disbelief over PMG Zambia’s activities. On Twitter and Facebook, hashtags like #PMGZambiaScam and #StopPonziSchemes are trending. Influencers are urging followers to report suspicious apps and schemes immediately.

Some online commentators also note that while social media has helped expose the scam, it also contributed to its growth—proof that digital platforms can both warn and deceive.

What Can Zambians Do to Protect Themselves?

Experts advise the following steps to avoid falling victim to scams like PMG Zambia:

-

Research before investing: Always verify if a business is registered with the SEC.

-

Be wary of “guaranteed” returns: No legitimate investment offers fixed daily profits.

-

Avoid referral-based schemes: If earnings rely on recruiting others, it’s likely a pyramid system.

-

Educate friends and family: Spread awareness about Ponzi schemes in local communities.

By following these guidelines, Zambians can minimize financial losses and prevent further exploitation.

Conclusion

The PMG Zambia saga is a harsh reminder that not all that glitters is gold. While the promise of easy money is tempting, scams like these can destroy livelihoods in a matter of weeks. Citizens must remain vigilant, educate themselves about financial fraud, and report suspicious schemes to authorities.

If you or someone you know has been affected by PMG Zambia, share this article, raise awareness, and help prevent others from falling into the same trap. Remember: knowledge is your best defense against scams.